Alabama | Alaska | Arizona | Arkansas | California | Colorado | Connecticut | Delaware | Florida | Georgia | Hawaii | Idaho | Illinois | Indiana | Iowa | Kansas | Kentucky | Louisiana | Maine | Maryland | Massachusetts | Michigan | Minnesota | Mississippi | Missouri | Montana | Nebraska | Nevada | New Hampshire | New Jersey | New Mexico | New York | North Carolina | North Dakota | Ohio | Oklahoma | Oregon | Pennsylvania | Rhode Island | South Carolina | South Dakota | Tennessee | Texas | Utah | Vermont | Virginia | West Virginia | Wisconsin | Wyoming

National Bank Notes were United States currency banknotes issued by National banks chartered by the United States Government. The notes were usually backed by United States bonds the bank deposited with the United States Treasury. In addition, banks were required to maintain a redemption fund amounting to five percent of any outstanding note balance, in gold or “lawful money.” The notes were not legal tender in general but were satisfactory for nearly all payments to and by the federal government.

National Bank Notes were retired as a currency type by the U.S. government in the 1930s, when U.S. currency was consolidated into Federal Reserve Notes, United States Notes, and silver certificates.

A gold certificate is a certificate of ownership that gold owners hold instead of storing the actual gold. It has both a historic meaning as a U.S. paper currency (1863–1933) and a current meaning as a way to invest in gold.

Banks may issue gold certificates for gold that is allocated (non-fungible) or unallocated (fungible or pooled). Unallocated gold certificates are a form of fractional-reserve banking and do not guarantee an equal exchange for metal in the event of a run on the issuing bank’s gold on deposit. Allocated gold certificates should be correlated with specific numbered bars, although it is difficult to determine whether a bank is improperly allocating a single bar to more than one party.

Silver certificates are a type of representative money issued between 1878 and 1964 in the United States as part of its circulation of paper currency. They were produced in response to silver agitation by citizens who were angered by the Fourth Coinage Act, which had effectively placed the United States on a gold standard.

The certificates were initially redeemable for their face value of silver dollar coins and later (for one year – June 24, 1967 to June 24, 1968) in raw silver bullion. Since 1968 they have been redeemable only in Federal Reserve Notes and are thus obsolete, but still valid legal tender at their face value and thus are still an accepted form of currency.

Large-size silver certificates (1878 to 1923) were issued initially in denominations from $10 to $1,000 (in 1878 and 1880) and in 1886 the $1, $2, and $5 were authorized. In 1928, all United States bank notes were re-designed, and the size reduced. The small-size silver certificate (1928–1964) was only regularly issued in denominations of $1, $5, and $10. The complete set is part of the National Numismatic Collection at the Smithsonian’s National Museum of American History.

Federal Reserve Bank Notes are banknotes that are legal tender in the United States issued between 1915 and 1934, together with United States Notes, Silver Certificates, Gold Certificates, National Bank Notes and Federal Reserve Notes. They were specified in the Federal Reserve Act of 1913 and had the same value as other kinds of notes of similar value. Federal Reserve Bank Notes are different from Federal Reserve Notes in that they are backed by one of the twelve Federal Reserve Banks, rather than by all collectively.

Federal Reserve Bank Notes were envisioned as a replacement for National Bank Notes, but that did not prove to be the case. They were backed in a similar way to National Bank Notes, using U.S. bonds, but issued by Federal Reserve banks instead of by chartered National banks. Federal Reserve Bank Notes are no longer issued; the only U.S. banknotes still in production since 1971 are the Federal Reserve Notes.

Large size Federal Reserve Bank Notes were first issued in 1915 in denominations of $5, $10, and $20, using a design that shared elements with both the National Bank Notes and the Federal Reserve Notes of the time. Additional denominations of $1, $2, and $50 were issued in 1918 as an emergency replacement for Silver Certificates, which were temporarily removed from circulation under the Pittman Act.

Small size Federal Reserve Bank Notes were printed as an emergency issue in 1933 using the same paper stock as 1929 National Bank Notes. They were printed in denominations of $5 through $100. A National Bank Note has a line for the signature of the president of the national bank, but the small size Federal Reserve Bank Note printed a bar over the label for this line, since Federal Reserve Banks had governors, not presidents.

The wording, “Or by like deposit of other securities” was added after the phrase, “Secured by United States bonds deposited with the Treasurer of the United States of America”. This emergency issue of notes was prompted by the public hoarding of cash due to many bank failures happening at the time. This also limited the ability of the National Banks to issue notes of their own.

Small size Federal Reserve Bank Notes were discontinued in 1934 and have not been available from banks since 1945. As small size notes, they have brown seals and serial numbers, as do National Bank Notes of the era. But while they look very similar, and both have the words, “National Currency” across the top of the obverse, they had different issuers and are considered to be distinctly different types of bills.

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 and issues them to the Federal Reserve Banks at the discretion of the Board of Governors of the Federal Reserve System. The Reserve Banks then circulate the notes to their member banks, at which point they become liabilities of the Reserve Banks and obligations of the United States.

Federal Reserve Notes are legal tender, with the words “this note is legal tender for all debts, public and private” printed on each note. They replaced National Bank Notes, which national banks issued from 1863 to 1935 under the authority of the United States Treasury. The notes are backed by financial assets that the Federal Reserve Banks pledge as collateral, which are mainly Treasury securities and mortgage agency securities that they purchase on the open market by fiat payment.

United States Notes, also known as a Legal Tender Note, is a type of paper money that was issued from 1862 to 1971 in the U.S. Having been current for 109 years, they were issued for longer than any other form of U.S. paper money. They were known popularly as “greenbacks”, a name inherited from the earlier greenbacks, the Demand Notes, that they replaced in 1862. Often termed Legal Tender Notes, they were named United States Notes by the First Legal Tender Act, which authorized them as a form of fiat currency. During the 1860s the so-called second obligation on the reverse of the notes stated:

This Note is a Legal Tender for all debts public and private except Duties on Imports and Interest on the Public Debt; and is receivable in payment of all loans made to the United States.

They were originally issued directly into circulation by the U.S. Treasury to pay expenses incurred by the Union during the American Civil War. During the next century, the legislation governing these notes was modified many times and numerous versions were issued by the Treasury.

United States Notes that were issued in the large-size format, before 1929, differ dramatically in appearance when compared to modern American currency, but those issued in the small-size format, starting 1929, are very similar to contemporary Federal Reserve Notes of the same denominations with the distinction of having red U.S. Treasury Seals and serial numbers in place of green ones.

Existing United States Notes remain valid currency in the United States; however, as no United States Notes have been issued since January 1971, they are increasingly rare in circulation and command higher prices than face value as items of numismatic interest.

-

Fr. 823 Sign.: Elliott, Burke, Bell, Wellborn Serial # F59005A Plate # Al/3

-

1902 $100 PB National Bank of Trinidad Colorado.

Charter # 2300

Serial # 2706

Only PB Known / Only 5 DB $100 known VF -

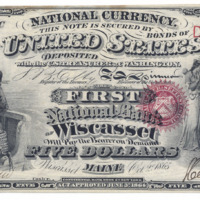

1865 $5 The First National Bank of Wiscasset, Maine

SN# 1500

-

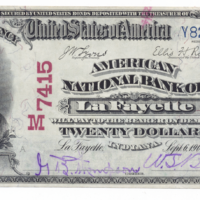

1902 Red Seal $20 American National Bank of Lafayette, Indiana

Charter # 7415

SN# 4207 -

1882 $10 The Central National Bank of Wilmington, Delaware

BB

Charter # 3395

SN# 4322 -

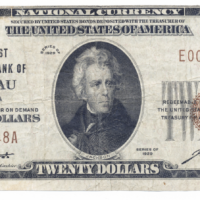

$20 The First National Bank of Juneau, Alaska

Type I

Charter # 5117

SN# E000048A -

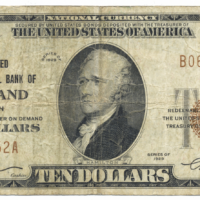

$10 The United States National Bank of Portland, Oregon

Type I

Charter #4514

SN# B060652A -

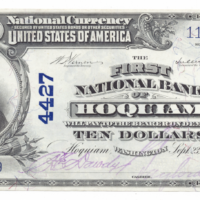

1902 $10 The First National Bank of Hoquiam, Washington

PB

Charter #4427

SN#11269 -

CHOICE UNC 64

1865 $1 Original Series The First National Bank of Kansas, Illinois

Charter #2011

SN#2854 -

1935D $1 Silver Certificate PMG 55 Solid #6’s

About Uncirculated

Fr #1613N Narrow (FF Block)

Clark | Snyder

SN# F66666666F -

1963A $1 Federal Reserve Note PMG 65* Solid #5’s

Gem Uncirculated/Excellent Paper Quality

Fr #1901-J (JA Block)

Granahan |Fowler

SN# J55555555A