Precious metals provide an alternative investment not directly tied to the stock market or a similar platform. Instead, gold and other metals are natural and were highly valued since long before the current stock markets. One of the easiest ways to invest in precious metals is by purchasing bullion. Discover the numerous benefits of bullion.

Bullion Offers Protection Against Stock-Market Swings

For investors who do not want to get involved with the stock market, precious metal bullion offers a form of protection against major market swings. Some people invest solely in precious metals for this precise reason, and even those who have many stocks often still purchase some bullion as a form of insurance and to diversify. It serves as a hedge against downturns and inflation.

For example, many financial advisors recommend putting three to five percent of your investments into gold. That amount can increase to 10 percent for people who are extremely interested in bullion.

Even though this may seem like a small percentage, it can add up to a substantial sum. The average nest egg for people age 55 to 64 is $107,000. At that amount, a 3 to 5 percent investment in gold could equate to between $3,210 and $5,350 in precious metal bullion.

Bullion Is Something You Can Hold

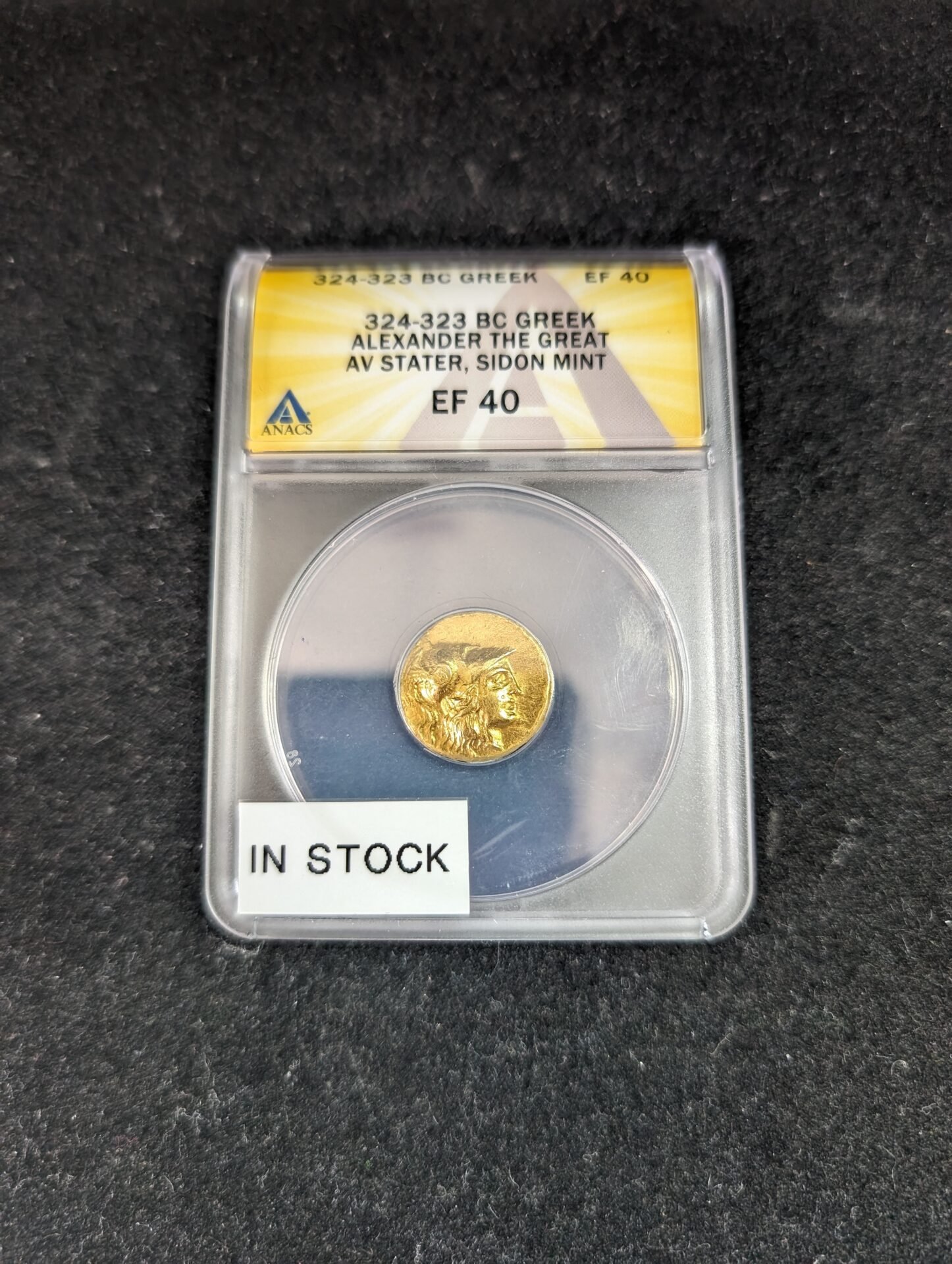

Unlike many other benefits, precious metal bullion is a tangible asset that you can hold. While this does not necessarily have an impact on its potential return, this is something that many people appreciate. Having a piece of gold in hand is satisfying.

As digital investments become more readily available, the benefit of holding an actual asset in hand has become even more important. People who own stocks, at least theoretically, can get paper certificates for the stocks they own. This is not the same as holding a bullion bar or coin. Additionally, most cryptocurrencies do not even come with paper. Many tech investments are largely intangible.

Bullion Is Compact With Regards to Value

Of course, bullion is not the only tangible asset that is not linked to the stock market which you can invest in. For instance, collectible art, rare books, and sports memorabilia also are investments.

Precious metal bullion, however, packs far more value into a small space than most of these other investments does. While a few prized investments, such as a famous painting or autographed sports card, might offer a comparable value-to-size ratio, the vast majority of investments do not have the same density with regards to value as precious metals do.

This consideration has a direct impact on how much it costs to store a tangible investment. Since even a small amount of bullion can be worth a tidy sum, precious metal bars and coins are easy to store. They do not need to take up much room in your house, and you do not have to rent a large secured storage space for them.

Bullion Is Easy to Maintain

Unlike all other tangible assets, including those that have high value-to-size ratios, precious metal bullion is much easier to maintain. Since the value of bullion is in the metal quantity and not so much in condition, you do not have to worry as much about taking care of bullion. In contrast, artwork, books, and sports memorabilia often require periodic care.

While periodic care can be fun if you like the assets you own, it also can be a chore and add to the cost of maintaining your investments. For instance, books need periodic dusting and should be kept in archival paper. Buying paper for every purchased book adds up if you invest in a large collection.

Bullion Is Free From Counterparty Risk

In contrast to some other investments, precious metal bullion is completely free from counterparty risk. Counterparty risk refers to the possibility that another party fails to meet their obligations, and the failure negatively impacts the value of an investment.

Bonds serve as a good example of counterparty risk, although many investments involve this risk. If the issuing business or government of a bond fails to complete the project for which a bond was originally issued, they may be unable to pay the bond back. In this situation, the bond becomes worth nothing because it will not be repaid.

Although the counterparty risk with most bonds is generally low, it still does exist. Additionally, other investments have much higher counterparty risks. For example, the chances of a startup that you invest in going bankrupt are fairly high.

With bullion, though, no counterparty risk exists. The investment is not based on a contract, so you do not need to worry about someone failing to uphold their portion of a contract.

To invest in precious metal bullion, contact Rocky Mountain Coin. The company has gold, platinum, and silver bullion available in both bars and coins.