Debunking 5 Myths About Gold Investments

In the vast landscape of investment options, gold has long been regarded as a viable divestment. Yet, despite its enduring popularity, gold investments often find themselves shrouded in myths and misconceptions. However, you might need help determining what is and is not true about gold investment. Let’s unravel the truth behind five commonly held misconceptions that surround gold investments.

- Gold Is Only for the Wealthy

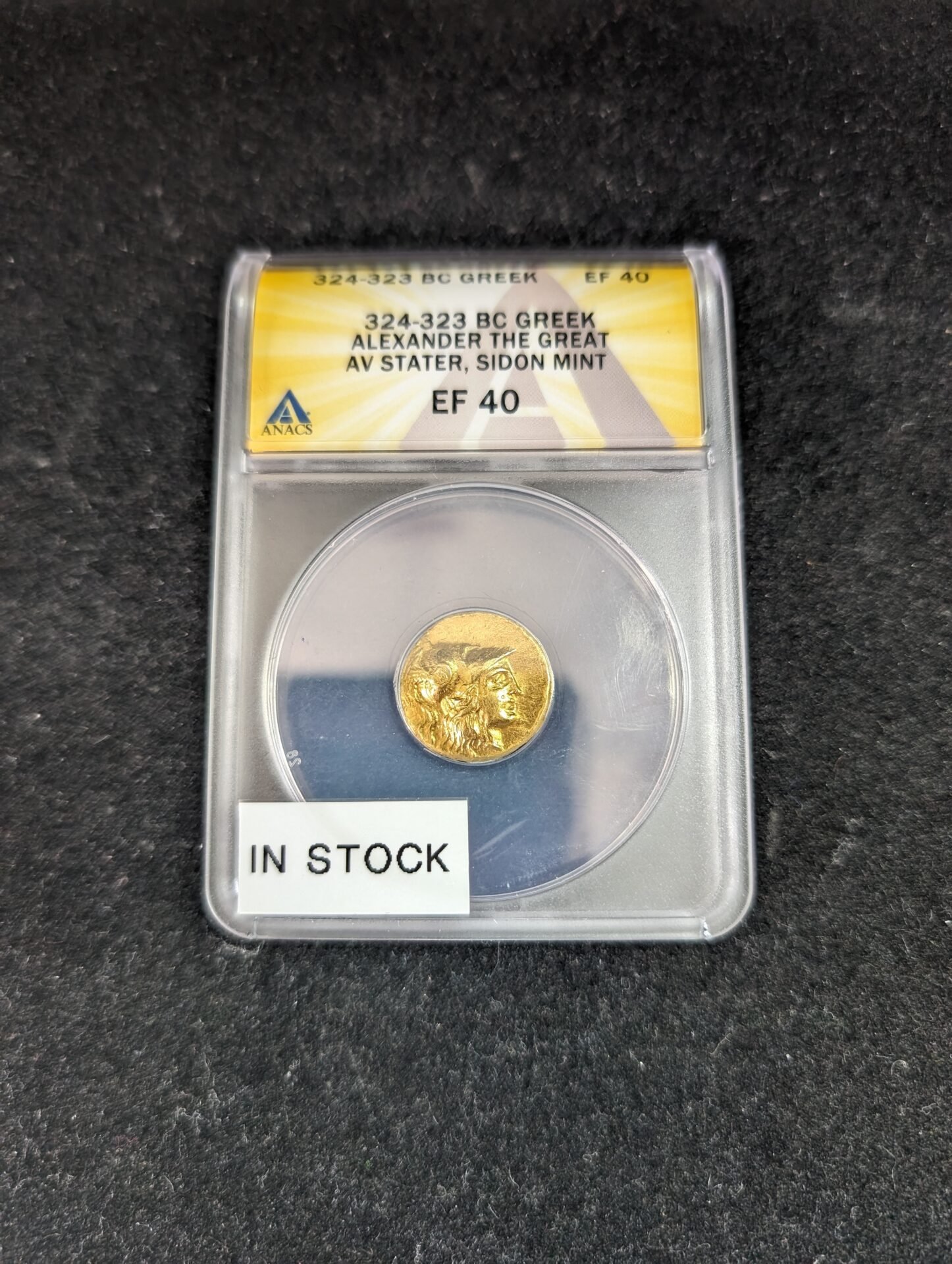

Gold bullion is an accessible investment option for those on tight budgets. Gold bars and coins exist in a wide range of sizes, making it possible to invest modest sums. For instance, gold coins are available in denominations ranging from 1/20 ounce to 1 ounce.

This allowance paves the way for investors to get familiar with gold investment with a smaller outlay of capital and, if they so choose, implement a dollar-cost averaging (DCA) strategy in which they purchase a little amount of tangible gold in coins or bars regularly. Gold can be a great way to broaden your holdings and is accessible to investors of all income levels.

- Gold Investments Are Difficult to Handle

The purchase and sale of gold have become simpler in recent years due to technological developments and the widespread availability of the internet. Investors can buy gold coinage and bars of varying sizes and values without leaving the house. In addition, you can find specialized storage services that offer safe locations to store gold bullion and insurance against theft or loss.

The procedure for selling gold is similarly uncomplicated and hassle-free. Investors can sell their gold bars at select gold dealers for top dollar and receive excellent service. The sale of individual holdings is simple and safe.

- Gold Is Obsolete

Gold has been saddled with the stigma of being an old-fashioned investment because it is a tangible commodity rather than a digital one. Gold may seem antiquated in comparison to more modern investments. However, the facts contradict this common belief. Gold’s durability and prestige make it an excellent investment.

Gold has served as a currency for centuries and continues to be highly valued, while the value of other contemporary investments is still very young and can fluctuate widely. The fact that many governments hold gold reserves as a means of insurance and economic stability speaks volumes about the metal’s value.

- Gold Does Not Offer Returns

According to this misconception, gold cannot offer its investors a good, sustainable return over the long term, or any return at all. Gold investment has historically provided profits for investors, thus this assertion isn’t totally true.

Gold’s meteoric rise in price after the gold standard was abandoned suggests that precious metal offers investors a competitively profitable return over the long run. Furthermore, gold is a more secure investment vehicle, meaning it may continue to pay returns to its investors even in the absence of any short-term dividends.

As such, gold is not merely a material tool of wealth preservation but also a practical means of generating profits.

- Gold Is A Risky Investment

Gold’s capacity to keep its face value amid inflation or economic uncertainty has made it a popular investment option for centuries. This makes it a useful diversifier, as you can use it to offset the risk of more conventional investments like equities and bonds.

Gold’s scarcity and persistent demand make it an extremely valued commodity across various economic sectors. The cost could fluctuate. However, unlike with other investments, the price of gold has never gone to zero. Investing in gold is a great choice with minimal danger.

If you need any help to start on your gold investment journey, reach out to Rocky Mountain Coin. We have various gold bullion, coin options, and other precious metals.