Ways to Invest in Gold

Gold is considered one of the most precious metals throughout history and across different cultures worldwide. This precious metal can be used as currency, in jewelry, and as an essential material in electronics. If you are into investing, gold is an excellent alternative to the conventional bond and stock market, as the precious metal is always in high demand, even when economies are volatile.

How can you start your gold investment journey?

Physical Gold

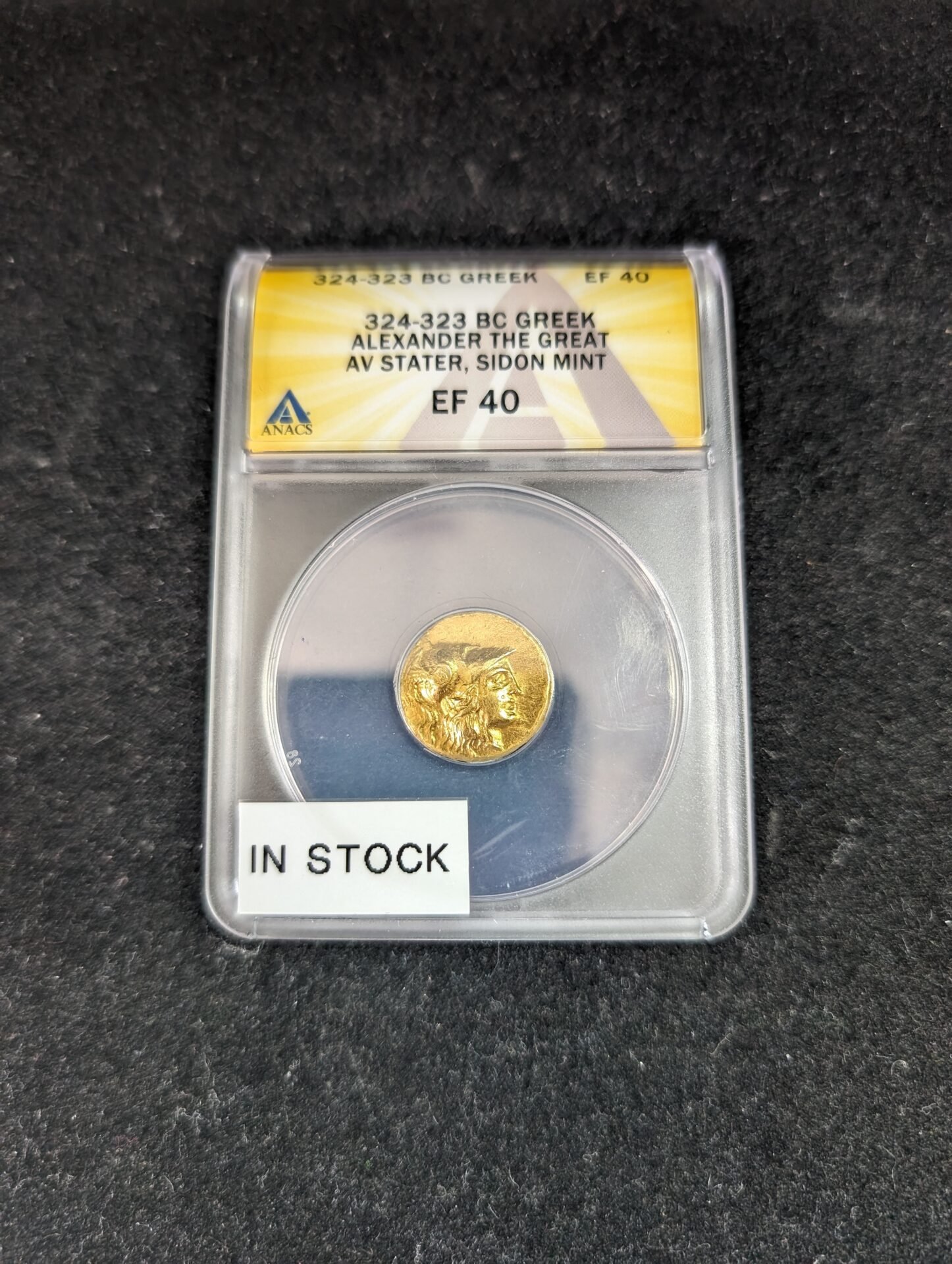

One of the easiest and most common ways to invest in this metal is to buy gold bullion. Gold bullion comes in the form of bars, and coins.

Gold coins come in a variety of sizes and shapes. You may have to pay extra for design elements such as collector values and engravings. Some of these coins are accepted as legal tender in their country of origin but may not be as convenient as standard currency. On the other hand, gold bars will come with the purity, weight, and manufacturer’s name stamped on them.

When you buy yours from a seller, ensure the seller is reputable. Your best option would be to buy from a local trusted source rather than online.

You can also invest in gold jewelry, but this is not an actual gold investment as jewelry includes costs extrinsic to the gold content. If you buy jewelry, you pay for branding and artisanship, which are not directly related to gold value. Additionally, the piece may be valued as an antique and is not an investment in precious metal.

Gold as a Commodity-Linked Structured Investment

Gold can maintain its value in any economic condition. If you buy gold as a commodity-linked structured investment, you decide on a base currency and investment period with the bank or broker. You will also agree on a target conversion rate that will be applied between the base currency and gold.

When the investment period ends, you get a coupon in gold or the base policy and the principal. If the gold appreciates against the currency, you are repaid in principal and coupon. However, if the gold does not appreciate, your investment is converted, and you get an equivalent of the principal and coupon in gold that is converted at the target conversion rate.

Investing like this may generate more interest than holding a currency and is ideal for an investor that is okay with getting paid in gold. If you are paid in gold, you can hold on to the gold, sell it, or reinvest it.

Gold Unit Trusts and Exchange Traded Funds (ETFs)

You can invest in gold without buying the metal physically through a gold exchange-traded fund. This fund holds different gold-backed assets. Some ETFs may include shares in gold derivatives and miners, while others may mimic gold price movements. The asset will determine the value of the ETF and its performance.

Gold ETFs trade like stocks, which means they are liquid. You can sell them off as you wish. This type of gold can be bought at lower prices for new investors because you do not need to purchase actual gold. You can check the spot price with a qualified broker to include gold in your portfolio.

You can also buy gold in the form of unit trusts consisting of assets and gold derivatives. Like ETFs, some unit trusts invest in physical gold, and others in miners’ stocks, bulk commodities, and other precious metals.

You need to find a reliable dealer of gold before you buy. We are a qualified collector and dealer of precious metals and rare coins at Rocky Mountain Coin. We have the expertise and skills to help you choose the best metal for your investment. Reach out to us today.