Those who have long dabbled in precious metal investments or ETFs may have some interest in expanding their collection to include physical bullion bars and coins as well.

However, even those who have a background in coin collecting and precious metals can find their entry into this realm a bit overwhelming. How can you maximize your investment while providing yourself with the personal satisfaction of owning assets you can see and touch?

Read on to learn more about some of the primary differences between different types of bullion coins. You’ll also learn about what to keep in mind when expanding your collection of precious metals to include bullion investments.

What Bullion Is

“Bullion” refers to any bulk amount of precious metal, but most commonly describes silver, gold, or platinum. Bullion can take many forms but is usually cast into either bars or coins.

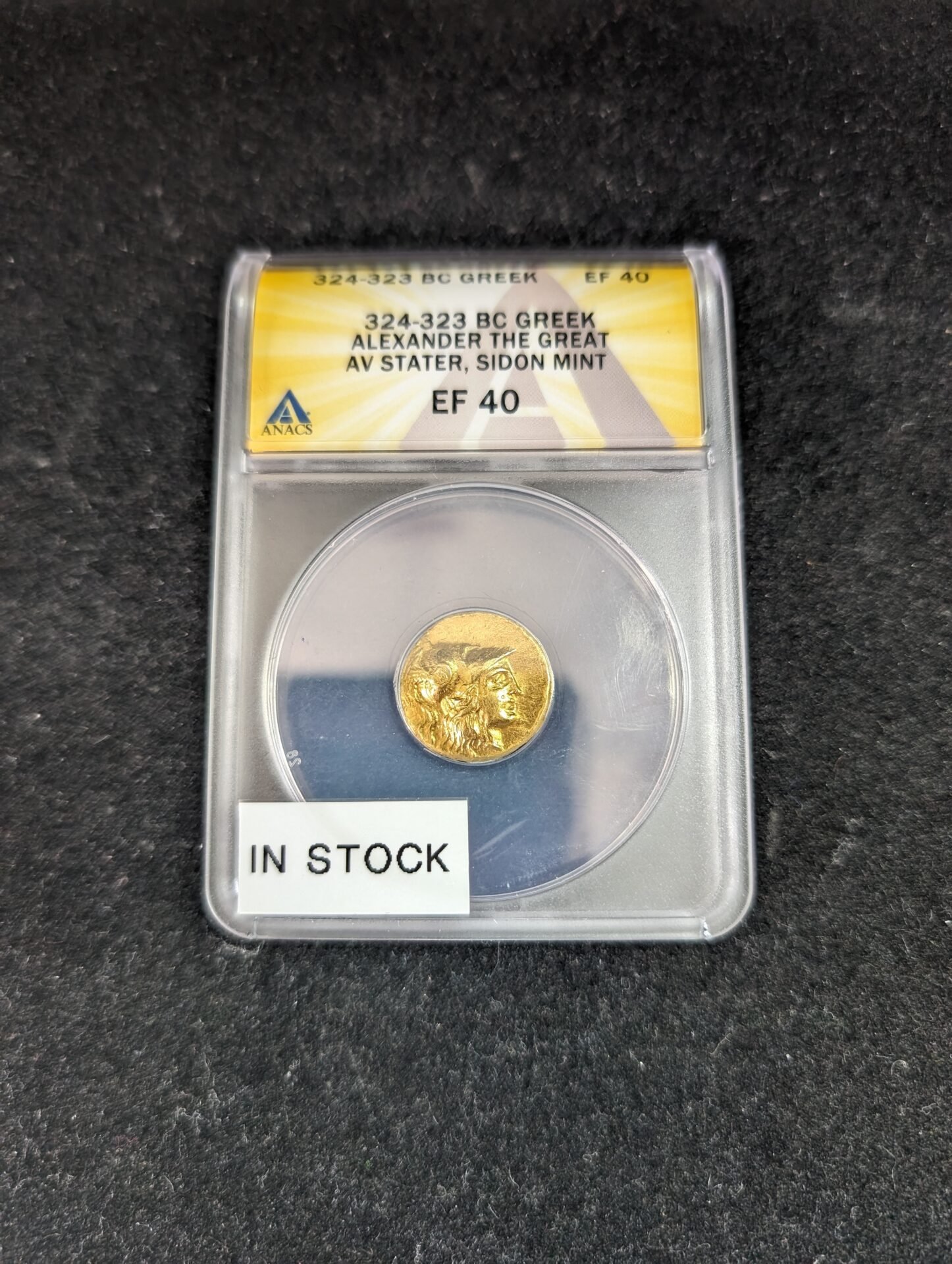

Proof bullion coins are designed for collectors only; these coins are usually sold individually, in protective cases, and can be obtained directly from the U.S. Mint. These coins are often featured on television, radio, and magazine advertisements or as part of a collectors’ series.

Uncirculated bullion coins are designed to serve as investments rather than collector’s items. These coins can be minted by the U.S. Mint (as well as other government mints) but are sold directly to investors (with a small markup) rather than being available for retail sale.

The primary difference between bullion coins and non-bullion coins lies in their purpose. While non-bullion coins may be made of the same precious metals included in bullion coins, their value is usually dependent upon their “grade,” or quality, which can render them more expensive than either their face value or the value of their component metals. Meanwhile, the value of a bullion coin, just like a bullion ingot or bar, is based primarily on the current market (known as the spot) price of the precious metal it is made from.

Why Bullion Can Be a Good Investment

If you’re considering investing in precious metal bullion bars or coins, there are a few advantages that you wouldn’t have with other types of investments. Because gold and silver both have an intrinsic value, they tend to be more stable than cash, especially in an emergency. If you are in an area hit by a hurricane or other natural disaster that takes credit card processing systems offline and makes cash scarce, you may be able to use your bullion to pay for necessities when your other assets are unavailable.

Gold and silver are also in limited supply. While the Federal Reserve can print money seemingly at will, the U.S. Mint and other government and private mints can only produce bullion coins with the metal they have available. This limitation can help serve as a hedge against inflation; when you purchase gold or silver bullion, you can rest assured that you’re purchasing a physical asset that can’t be made in a factory or on a printing press.

Bullion and bullion coins can be particularly good investments due to their lesser “buzz factor.” While rare coins can be collector’s items, often selling for more than their component value because of high levels of public demand, bullion coins and ingots are a quieter investment with a more stable value.

How to Get Started

Before you begin buying, you’ll want to do some preliminary research. First, you’ll want to decide whether you’re interested in gold or silver bullion (or both) and whether you’d rather purchase ingots, bars, or coins.

Next, you’ll want to consider storage. If you’re the type of person who likes to have your assets in an easily accessible place, you may opt to purchase a safe or other type of secured storage locker to store your bullion at home. In other cases, you may choose to rent a safe deposit box or other public (but secure) storage facility for off-site storage.

Many bullion and coin dealers will provide a certificate of authenticity or guarantee that ensures you receive exactly what you order.

Finally, review your homeowner’s insurance policy. While stocks, bonds, and other investments aren’t FDIC insured or otherwise protected against loss, they do tend to be more “secure” than physical assets that are stored in your home. Adding your bullion investments as a line item on your insurance policy will help you to be reimbursed if your bullion is stolen during a burglary or damaged in a storm or other event.

By taking these steps and contacting your local coin dealer, you’ll be able to plunge full-force into bullion investment without letting worries or fear of the unknown hold you back.